RichVintage/E+ by way of Getty Photos

[This text was initially printed March 23 for members and trial subscribers of Contained in the Earnings Manufacturing unit.]

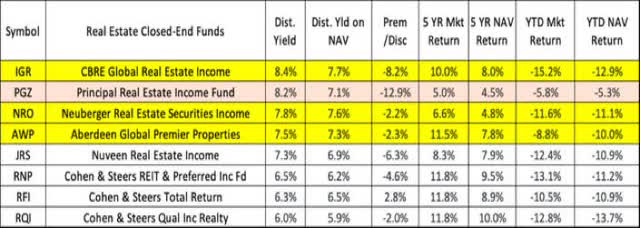

Listed here are the eight actual property funds listed in CEF Join. There’s really a ninth, Cohen & Steers Actual Property Alternative (RLTY) that was simply began a few month in the past, that I am not contemplating but. (Notice should you go to CEF Hook up with replace these stats that it has IGR’s distribution yield mistaken. Calculate it with its appropriate distribution of $zero.06 per thirty days. It is nonetheless the best yielding actual property fund.)

The three we personal are:

- CBRE International Actual Property Earnings (NYSE:IGR) might be my present favourite, yielding Eight.four% with a -Eight.2% low cost and long run file. It is in our Hunker Down mannequin and my private portfolio.

- Neuberger Actual Property Securities Earnings (NRO), which yields 7.Eight%, with a -2.2% low cost and likewise a reasonably good long run file (Eight-9% each year over the previous 10 years, though the desk solely goes out to 5). It is also in our Hunker Down mannequin.

- Aberdeen International Premier Properties (AWP), which yields 7.5%, additionally has a modest low cost (-2.three%) and longer-term file. It is in our Widow & Orphan mannequin in addition to in my private portfolio.

SB

Notice: What we already personal is highlighted in yellow; what’s underneath dialogue as a possible addition is in pink. [Since originally publishing this article I have also purchased PGZ.]

An extended-term investor cannot actually go mistaken with any of the opposite decisions both. The three Cohen & Steers funds, RNP, RFI and RQI, and Nuveen’s JRS, all have good data too.

IGR is the one I’m shopping for extra of proper now, with its highest yield of all the true property closed-end funds (that it not too long ago elevated 20%), in addition to the second largest low cost. However all three symbolize cheap reinvestment candidates, so anybody who owns them and has them on automated dividend reinvestment actually has no motive to alter.

In addition to the three we already personal, there’s a fourth one, Principal Actual Property Earnings (PGZ), which is now additionally on my radar display, though it had not been till I began writing this text. I had by no means taken PGZ too significantly through the years as a result of it appeared smaller with property of solely about $100 million, and I felt a bit safer with the bigger actual property funds and their managers. However after I ran the numbers on the CEF Join-listed actual property funds, I used to be to see PGZ close to the highest when it comes to yield and low cost, though its long run return was not fairly pretty much as good as a number of the others. However then I checked additional and see that its long run efficiency since inception in 2013 is sort of Eight%, which compares favorably. Then I noticed that its possession by institutional buyers has not too long ago elevated to over 25%, with activist Saba Investments (the identical group that manages BRW, and the ETF CEFS) proudly owning a serious chunk.

So after I put all that collectively: Eight% yield, huge low cost, activists circling, and – another factor – a distribution that was simply elevated by 14% two months in the past, it appears like a worthwhile hypothesis.

So whereas I am not recommending changing any of the “core” actual property funds in our fashions with PGZ at this level, I do plan to purchase some into my private portfolio, and preserve a pointy eye out for tender presents or different actions which may come alongside to spice up its worth. The truth that it has such a big low cost could also be what attracted the activists and institutional buyers, so it would not be shocking to see them encourage (i.e. drive) actions to attempt to treatment that, resembling a young supply. (Hyperlink right here for more information on activist methods.)

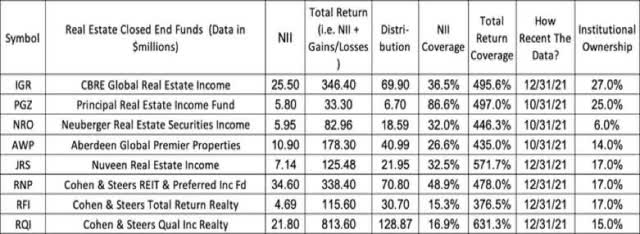

Distribution Protection

Notice that each one three of our present actual property funds (IGR, AWP, and NRO) had wonderful protection of their distributions by their GAAP earnings throughout their most up-to-date reported monetary intervals, with better than 400% protection in each case. In truth, your complete business had wonderful protection, as you’ll be able to see should you go down the listing.

SB

PGZ stands out as really having had higher protection by its web funding earnings (NII), which suggests it’s apparently not as dependent as its friends on capital features in its actual property portfolio to cowl its distribution. This makes it comparatively much more engaging.

Credit score vs. Fairness Threat

By now many readers are bored with my comparability of investing in credit score as “betting on horses to merely end the race”, whereas if you purchase fairness it is like betting on the horse to really win, place or present. In different phrases, with a credit score wager all the corporate has to do is keep alive and pay its money owed. So even a mediocre efficiency the place the inventory goes nowhere will probably be a profitable funding for the consumers of the agency’s debt. However fairness buyers are making BOTH a credit score wager (i.e. that the corporate will keep alive and pay its money owed, in any other case its fairness will probably be nugatory) AND an extra wager that the corporate is not going to solely keep alive, however will excel (i.e develop its earnings) and due to this fact be price extra as an fairness funding. For those who’re NOT bored with this and need to learn extra about it, take a look at this current article.

For that motive, it would not be rational to purchase the fairness in an organization until you anticipate the return to be GREATER than no matter you’d be paid as a credit score investor (who in fact is taking much less danger).

That is why I focus a lot consideration on discovering methods to put money into credit score or credit-like asset lessons (excessive yield bonds, CLOs, BDCs, different mounted earnings) that pay equity-like returns (Eight-10% or so).

I think about funds that purchase inventory in REITs and different actual property corporations, although it could technically be “fairness,” to be largely credit-like dangers. That is as a result of actual property investing is similar to “Earnings Manufacturing unit” investing (or appropriate with an Earnings Manufacturing unit technique) as a result of the worth of the funding largely is determined by the money movement supplied by the workplace constructing, purchasing middle, cellphone tower, warehouse or different actual property being held. Most main actual property buyers put money into property with long-term tenants and predictable money flows. It’s these money flows, and the credit score of the tenants behind them, that offers the constructing or different actual property asset its worth to a long-term investor. So I see actual property investing as very comparable, when it comes to the dangers taken and the “river of money” that it generates, to the credit score and different mounted earnings property (together with even high-yielding equities like utilities, and so on.) that make up such a big a part of our Earnings Manufacturing unit portfolios.

Abstract/Conclusion

- Our present actual property fund holdings – IGR, NRO, AWP – are all doing high quality and advantage reinvestment and compounding for these so inclined.

- IGR, having simply elevated it distribution, is my favourite of the three and the one I’m placing extra money into personally.

- PGZ, which I beforehand ignored and disregarded, now appears fascinating (not simply to me however to activist buyers like Saba), and is price a hypothesis, so I plan to purchase some at this time.

That is all people! Sit up for your feedback and questions.

Thanks!

Steve