Funtap/iStock by way of Getty Photographs

Funding thesis

AG Mortgage Funding Belief, Inc. (NYSE:MITT) appears undervalued primarily based on conventional valuation metrics and trades zero.54x its guide worth. Nonetheless, the corporate has not recovered from the pandemic but whereas the administration restructured its portfolio to residential actual property and offered all non-core property. MITT will profit from the rising rate of interest atmosphere however its common portfolio yield is effectively beneath its friends. I’m at the moment impartial on MITT.

Enterprise mannequin

AG Mortgage Funding operates as a residential mortgage actual property funding belief in the USA. The corporate went by a portfolio simplification in 2021. The administration offered nearly the entire non-core property and decreased the publicity to business investments to have the ability to deal with core actions. As of December 31, 2021, 80.5% of fairness was allotted to residential investments, and 19.5% of fairness was allotted to company investments whereas as of December 31, 2020, solely 56% of fairness was in residential investments. I might name this a radical portfolio transformation, nevertheless, as a result of MITT’s smaller market cap dimension, it was comparatively straightforward to do in comparison with bigger market cap mREITs.

2022 expectations

Whereas 2020 was a catastrophic 12 months for MITT and 2021 was a 12 months of restructuring, 2022 may convey the corporate again from its ashes. Like all mREITs, MITT additionally works greatest when rates of interest are on the rise and spreads can widen. The Fed has already rose rates of interest as soon as and plans to do 6 extra instances in 2022 to sort out inflation. As well as, MITT’s portfolio restructures to residential actual property can come out effectively in the long run because of the provide and demand traits of the residential actual property market suggesting that it’s going to proceed to develop regardless of the speed hikes.

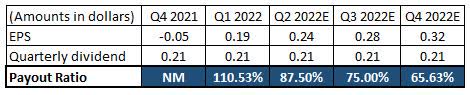

The widening unfold will positively affect MITT’s curiosity earnings within the second half of 2022 however I’m not sure but that the administration can totally capitalize on this. It’s because the portfolio’s weighted common yield is much lower than its friends. MITT solely has a weighted common yield of three.eight% whereas one of many largest residential mREIT: MFA Monetary (MFA) has a weighted common of round 5% as of December 31, 2021. MITT will announce its first-quarter outcomes on Might four, 2022, earlier than the market open. After hectic EPS leads to 2021, the analysts anticipate extra balanced EPS outcomes for 2022.

Valuation

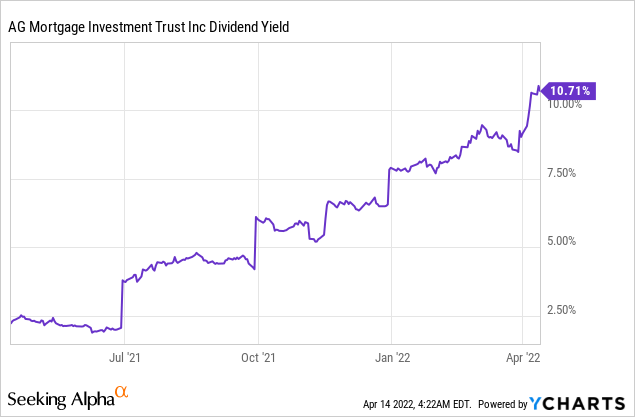

Technically talking MITT is undervalued primarily based on conventional valuation metrics. The corporate’s ahead Non-GAAP P/E ratio is 7.56, a bit over 30% decrease than the sector median of 10.42. MITT’s worth to guide ratio is zero.54 whereas the trade common is zero.80. That is primarily because of the falling inventory worth as a result of the corporate’s guide worth has been on the rise in 2021. As well as, MITT is at its dividend yield peak and for the time being you should buy the corporate with its greatest dividend yield within the final 12 months. MITT additionally trades nearly at its lowest level in a 12 months and because the begin of 2022, the worth has fallen by nearly 25%.

Regardless of all of this technical undervaluation, I don’t assume MITT is undervalued however slightly pretty priced. They’re lagging behind their opponents with a lot decrease portfolio yield, their portfolio is filled with dangerous property, and because of the restructuring, the administration offered or exited the much less dangerous business investments that they’d beforehand. I’m satisfied that the market is priced in these basic dangers and I’m not shopping for MITT simply but.

Firm-specific dangers

A good portion of MITT’s residential mortgage portfolio is Non-QM loans (72.9% as of December 31, 2021). Non-QM loans are typically loans to finance or refinance one-to-four-family residential properties that aren’t thought-about to fulfill the definition of a Certified Mortgage by tips adopted by the CFPB and could also be thought-about to be decrease credit score high quality. This makes MITT’s portfolio riskier than its friends. E.g. MFA has Non-QM loans as effectively however that solely represents roughly 41% of its complete portfolio.

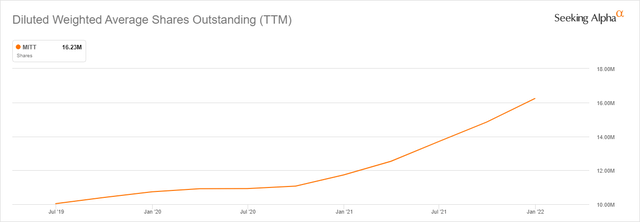

Prepayments dangers will stay vital within the second half of 2022 however when the rates of interest begin to enhance additional this danger issue will diminish, for now, we have to calculate prepayment danger as effectively. MITT has been continually issuing shares that erode shareholder worth and decrease EPS to finance its operations. The one optimistic issue is that whereas issuing frequent inventory on the similar time the administration is redeeming most well-liked shares.

Searching for Alpha

My tackle MITT’s dividend

Present dividend

MITT is yielding at 10.71% the best it has been within the final 12 months. The corporate paid a constant dividend till the pandemic when the administration needed to droop the dividend funds. Since then they reinstated the dividend in 2021 and at the moment paying $zero.21 per share quarterly.

Future sustainability

The payout ratio is stretched to its limits for the time being and I see no room for future will increase. In keeping with analyst estimates, they anticipate a $zero.21 per share so no will increase are anticipated for 2022. Curiously for 2023, the consensus price is $zero.205 which may imply a dividend minimize. I don’t imagine the administration would minimize the dividend in 2023 as a result of the exterior financial elements are delivering MITT’s favor with the upper rate of interest atmosphere which is able to widen the unfold. This may ease the strain on its payout ratio in 2022 and 2023 if the administration doesn’t enhance the dividend.

The desk is created by the writer. All figures are from the corporate’s monetary statements and SA Earnings Estimates.

Ultimate ideas

MITT is heading for a very good 2022 with significantly better anticipated outcomes than 2021 or 2020. Nonetheless, its funding portfolio’s common weighted yield is far decrease than its friends and it additionally accommodates rather more dangerous property. The corporate has a gorgeous dividend yield and I’m comparatively assured that the administration will be capable to preserve the present payouts as a result of optimistic exterior elements. Nonetheless, I’m not that assured in worth appreciation. I imagine the present worth is truthful and all of the dangers are priced in.