Writer’s Be aware: That is the shorter model of an Article revealed on iREIT on Alpha on the fifth of April 2022.

mtcurado/iStock Unreleased by way of Getty Pictures

Expensive subscribers,

I am a giant proponent of placing cash to work in secure firms – ideally multinational ones. This text is a continuation of that pattern, and we’ll be an organization I’ve held for quite a lot of years at this level. Right here I am speaking concerning the French multinational insurance coverage large AXA (OTCQX:AXAHF) (OTCQX:AXAHY).

Whereas a lot of you won’t be closely invested in French firms, I argue the most effective of them supply unbelievable diversification potential and upside – and AXA’s yield is excessive sufficient that even these withholding taxes, post-recoup, should not be too excessive.

Let’s set up a baseline thesis for the corporate AXA.

AXA – What does the corporate do?

AXA has a 200+ 12 months historical past going again all the way in which to 1816, and thru the course of its historical past, has acquired companies left and proper till altering its title to AXA again in 1985. Since 1990, the corporate has accomplished over 5 main M&A’s, and following the monetary disaster, is was thought of the second-most highly effective transnational company, when measured when it comes to company management over world monetary stability.

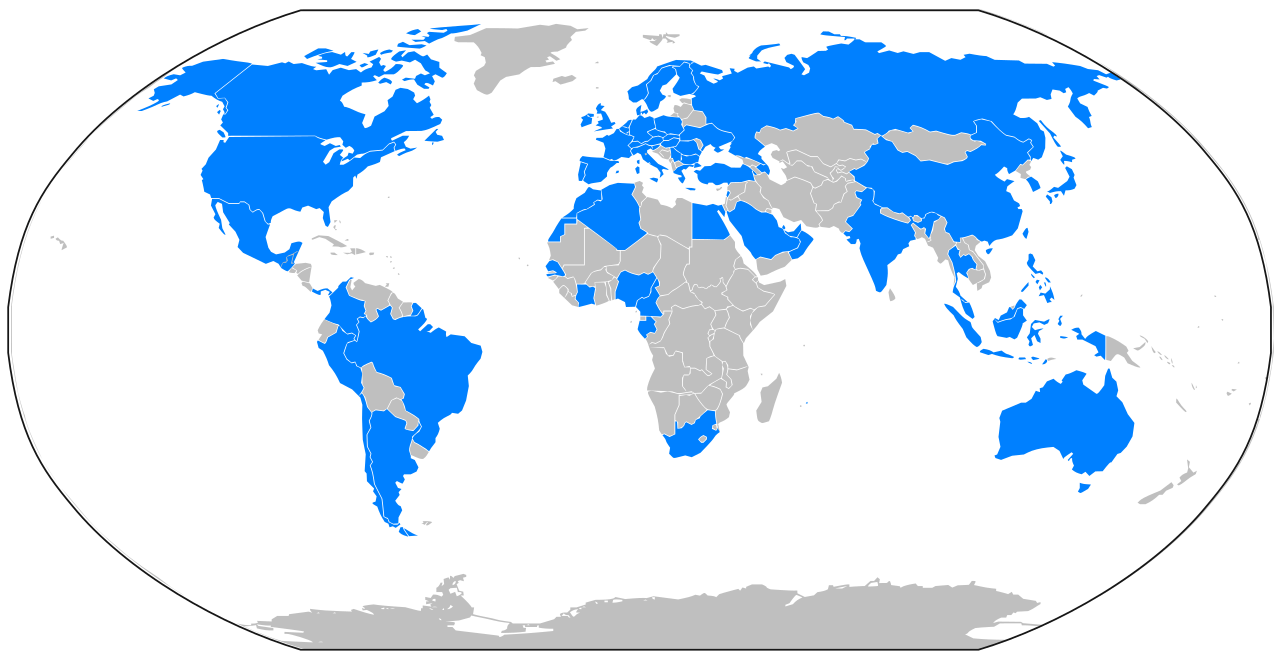

The title AXA is not an acronym, fairly it was chosen as a result of it may be pronounced by anybody from any nation – which is an efficient factor when your attain seems one thing like this.

AXA World Operations (By Cflm001 – Personal work, CC BY-SA four.zero, Wikimedia)

The corporate is an absolute market chief within the insurance coverage market and is among the many prime/largest insurance coverage firms on earth. It’s, on the similar time, additionally one of many world’s largest asset managers, working beneath the AXA IM in Europe, and beneath AllianceBernstein (AB) within the USA.

For these shopping for AXA at interesting valuations (similar to myself), the corporate can supply yields of over 7.5%, even now at over 6.7% well-covered by earnings. The corporate’s dividend coverage requires a comparatively constant portion of earnings, with out a lot flexibility to determine a dividend custom or proceed one throughout poor years, as seen in 2019 when the corporate minimize the dividend.

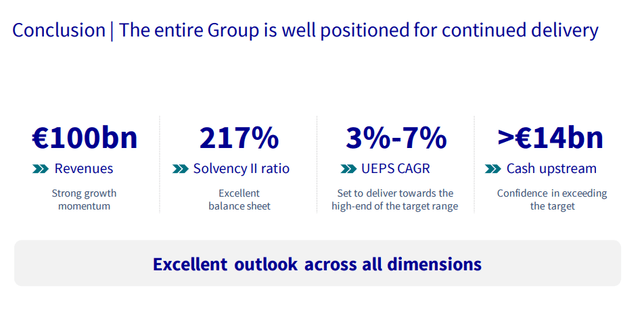

AXA has no worrying debt and is A rated or equal by each one of many main companies on the market, and has a2021 solvency II ratio of 217%.

The corporate is what’s identified within the enterprise as a multi-line insurer with, as I discussed, a number of a long time of M&A-based progress in its briefcase. Its begin as a tiny French operation and its present standing as a world chief is a testomony to administration talent over the previous 40-50 years. The corporate has a historic tendency of specializing in high-growth markets to steadiness out their mature market incomes (which are typically decrease, however extra secure). On the similar time, the corporate shouldn’t be tied to anyone funding and is fast to chop an unprofitable operation from its portfolio when wanted. The French large has additionally acquired companies in Colombia, Nigeria, Egypt, Azerbaijan, and Poland, one of the vital enticing insurance coverage markets in Central and Japanese Europe. Thanks to those developments, AXA now has greater than 108 million clients. The corporate now has greater than €100B in annual income, and nearly €7B in underlying earnings for the 2021 interval, a rise of just about 61% in comparison with 2020.

The corporate is at the moment present process, or nearly accomplished with, a strategic transformation the place the aim was to maneuver the corporate in keeping with a extra fee-based enterprise mannequin. Over 90% of the corporate’s earnings at the moment are fee-based/technical.

The corporate’s operations as of 2021 are reported when it comes to Property & Informal Insurance coverage, Life & Financial savings, Well being Insurance coverage, and Asset administration. There’s additionally a “Holdings & Different section). Over the previous few years, the corporate has slowly shifted away from a life focus as a result of rate of interest sensitivity that overexposure to the section brings. At this time, barely north of half of the corporate’s earnings, and fewer than half of the revenues come from the Life section, with the rest coming from Non-life and asset administration.

All the firm segments confirmed progress for 2021, with Property & Informal exhibiting 151% earnings progress and asset administration up 25% YoY as properly. The opposite segments grew slower at 2-Three%, however nonetheless confirmed constructive path. RoE noticed vital enhancements and is now on the high-end of the corporate’s goal vary, near 15%, and the Solvency II ratio elevated by nearly 17% YoY. The corporate’s gearing is, as of 2021, lower than 27%, with one fee of a Tier 1 debt of $850M in early 2022, and issuance of latest debt in early 2022 as properly.

The corporate’s re-aligning of its portfolio is paying off, with a decrease reliance on capital-intensive Financial savings merchandise and interest-rate delicate Life insurance coverage operations. Gross sales in these legacy segments stay stable, and the corporate has key market management in France right here at near 9% of your complete market, in addition to 10% of the Swiss and nearly Eight% of the Belgian market.

It could be honest to, on some stage, take into account AXA to be a French response (and western European response) to the German large Allianz (OTCPK:ALIZY).

By way of medical health insurance, we’re seeing a shift from particular person protection/insurance policies to group insurance policies as a result of introduction of obligatory company well being protection – however the ebbs and flows listed below are pretty nation-specific with developments just like the insurance coverage tax placing stress on earnings within the UK particularly. To go particularly into every nation AXA operates in and the insurance coverage/well being specifics of the nation would take too lengthy – so I’ll merely say that gross sales in medical health insurance proceed to develop steadily, although not as quick as P & C insurance coverage.

P&C, in contrast to life, has extra ties to financial/GDP progress than rate of interest developments. AXA has been in a position to report progress on this as properly – huge progress throughout 2021, as a matter of reality, as financial situations previous to the Ukraine warfare did present normalization. AXA additionally has main market shares in P&C – as much as 14% in France, 20% in Belgium and 13% in Switzerland. These markets are recurring, and the corporate’s most vital markets in all of Europe. Legacy is sweet, and rising markets are rising even higher, with AXA specializing in P&C growth by means of, amongst different issues, the American XL acquisition, which is a part of the explanation the corporate’s progress was triple digits for the 12 months.

By means of the XL M&A, AXA is now the world’s main P&C Business strains insurer, and is integral to the corporate’s shift from life to a broader portfolio composition.

Whereas the asset administration enterprise appears small, it really generates over €2B in revenues and has over €804B in AUM. AXA is, due to this, among the many 20 largest asset managers in your complete world. This department of AXA is in want of progress and scale, and Allianz is considerably forward of AXA on this.

So, concluding firm construction a bit, we’re a beforehand predominantly life-focused insurance coverage enterprise, that is turned to a extra interesting insurance coverage section combine.

As a result of Life, P&C, and Well being are depending on completely different flows in society, similar to rates of interest, GDP progress, and political/well being developments, an overreliant insurance coverage enterprise will all the time endure volatility or “lumpy” earnings throughout downtrends and uptrends.

The corporate’s strikes have served to minimize the influence of those highs and lows. With the brand new enterprise profile, the earnings construction has moved to being extra weighted in the direction of P&C and Well being contributing nearly 50-60% to the FY 22 pre-tax underlying outcome.

AXA can be reshaping the enterprise in the direction of Unit-linked merchandise to extend its profitability. AXA expects substantial synergies from XL, and never all of those are absolutely realized as of but.

General, this has become a really interesting insurance coverage enterprise since its trough valuation once I purchased the corporate for lower than €16/share. At this time’s valuation is markedly completely different, and the corporate’s efficiency since then exhibits a full reversal in valuation.

AXA Valuation/Share value (Google Finance)

Let us take a look at some dangers for AXA.

Dangers for AXA

Among the extra basic and underlying dangers for the corporate have been addressed by what I’ll clearly state, is a profitable re-orienting of its portfolio and gross sales combine. It would not take away the chance of a low-interest-rate surroundings such because the one we have seen for the previous few years, nevertheless it absolutely lessens this influence.

As an alternative, I might level to AXA’s steadiness as considered one of its main dangers. AXA depends on mature markets, the place progress is sort of inconceivable in addition to rising markets, the place progress is less complicated however the place dangers are far greater. The corporate has a comparatively good monitor report in managing these two sectors properly and delivers progress in addition to stability over time, however a fallacious transfer within the rising market path can show disastrous to earnings and dividends (in addition to returns). The present geopolitical state of affairs could not have come at a a lot worse timing for AXA, on condition that it very lately tied up most of its capital within the XL M&A. If there have been vital shortfalls wherever, this is able to be seen within the quarterly and annual developments. And whereas this would not threaten AXA basically, it will actually trickle right down to earnings and returns.

On the constructive aspect, AXA has no materials/related publicity to both Russia or Ukraine. AXA is not the one one to say this – Munich Re and (OTCPK:MURGY) Swiss Re (OTCPK:SSREY) just about say the identical right here. But it surely’s nonetheless transferring into this type of geopolitical quagmire with a steadiness sheet that is been drawn on as a result of current M&A.

Outcomes have been one readily available – the corporate’s buybacks are positives, as is the dividend enhance. Nonetheless, XL did not precisely ship the blockbuster efficiency I anticipated from it, and missed earnings by 2% to my forecast. That is weighed up by robust efficiency in all places else – however AXA paid good cash for XL, and it is a disappointment to see them miss the mark.

Regardless of being considerably strapped for money after the M&A, the 2021 outcomes have been wonderful (minus XL), and the elevated solvency ratio does go away room for the corporate to behave on additional shareholder returns right here. I see the potential for a couple of dangers with AXA, primarily tied to money and remaining ties to rates of interest, however not a lot past that.

Lots of it’s tied to XL, which ought to ship higher outcomes going ahead – in accordance with AXA’s personal expectations.

AXA Outlook (AXA IR)

AXA’s valuation

My constructive stance on AXA has by no means been all that fashionable or garnered all that a lot consideration right here on SA. Most of my earlier articles, or articles together with AXA as a decide, actually have not delivered or brought about many feedback or messages – and I do often get some messages about my picks.

That is unhappy to me, as a result of AXA, as you may see should you’d purchased it dirt-cheap, may have resulted in returns, together with dividends, of over 80-90% in lower than 2 years.

That is the ability of valuation-centric dividend investing. Now, my place was initially about €7,000 – and up about 95% together with dividends and FX. When AXA at the moment, we’re seeing a really resilient firm regardless of probably unfavorable financial developments within the close to future. The dividend yield can be providing an upside potential, because of the next dividend and given the brand new payout vary at 50-60% of adjusted earnings. With XL included, we must always see continued progress in that dividend for the following few years or so.

On a peer foundation, AXA’s closest friends are Allianz, Zurich, Generali (OTCPK:ARZGY), and Sampo (OTCPK:SAXPY). On this group, the typical P/E lies near 11-12X – AXA is undervalued to this a number of – and can be undervalued to P/B multiples, and provides a greater yield than all of its opponents at present valuations. From a peer-based perspective, the corporate is at a couple of 10-15% low cost to averages, with the very best low cost in P/B.

The common presently is round €30.5/share, and 18 out of 20 analysts take into account the corporate both a “BUY” or an “Outperform”. Whereas I might say the €30.5 value is justifiable – I might go decrease to a €28.5/share value goal, extra in keeping with a fair-value peer common.

Fairness analysts similar to Alpha worth have a PT of €28.7 for AXA (Supply: AlphaValue).

At a longtime PT of round €28.5, the present upside is round 7-Eight%.

Thesis

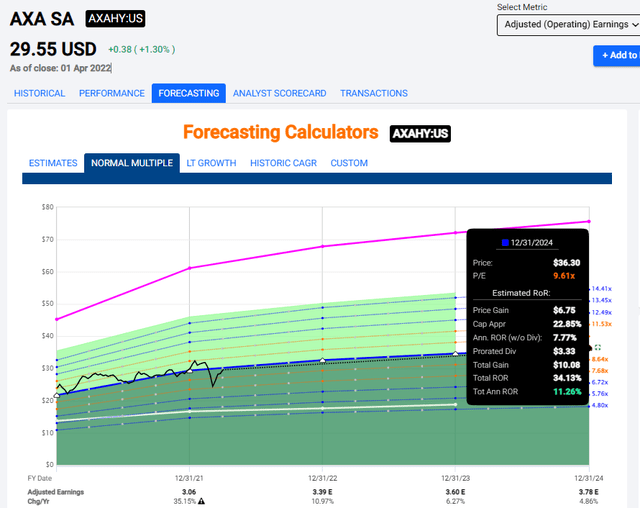

AXA has an ADR as properly – and whereas the upside when it comes to reversal has pale, the upside from progress continues to be very a lot there, with an 11-12% annual CAGR primarily based on a 7% common annual EPS progress price.

F.A.S.T. graphs AXA Upside (F.A.S:T graphs)

Is it the most effective upside out there available on the market at the moment? I might say that is not the case at this valuation – nevertheless it nonetheless provides a excessive yield with an upside and an A-rated insurance coverage firm with a world profile. For buyers searching for European publicity, there are a couple of choices – and should you’re searching for French and finance – AXA is without doubt one of the greatest choices on the market, in my view.

With the addition of XL, the corporate has develop into a world energy participant that lacks the earlier sensitivity to life and rates of interest it as soon as had. A rising rate of interest surroundings must also stimulate this firm’s progress profile for the following few years, and I count on between 6-9% EPS progress per 12 months going ahead, even with Ukraine and Russia as they at the moment are. In 2024, I count on gross sales revenues of €130B for the corporate, and delivering EPS of near €Three/share, permitting for a €1.6-€1.Eight/share dividend.

I at the moment have a €10,000+ place in AXA, and I am in no hurry to promote right here.

AXA is a “BUY” to me, and one with upside.

Listed below are my targets for the corporate.