By Andrew Paulson, CSLP, Lead Pupil Mortgage Guide and Co-Founding father of our companion web site StudentLoanAdvice.com

With lower than a month earlier than the mortgage vacation was to finish in Might 2022, the US Division of Training has postponed federal scholar mortgage funds but once more. Direct federal scholar mortgage funds have been on maintain now for greater than two years courting again to March 2020, and now, those that took out loans haven’t got to start paying them again until at least September 1, 2022.

There’s a school of thought that claims now that the scholar mortgage vacation has been prolonged but once more, possibly it is best to proceed paying down your loans. I’ll focus on why that’s a nasty concept for these going for scholar mortgage forgiveness—and why it’s each good and unhealthy when you nonetheless have large scholar debt from medical college (or grad college) however aren’t going for forgiveness.

First, let’s assessment how we acquired right here:

In March 2020, President Donald Trump, by the use of the CARES Act, froze curiosity and funds for debtors with direct federal scholar loans. This additionally offered reduction for debtors in default. The primary extension was set to run out in September 2020. With the pandemic persevering with to wreak havoc on the world, it was postponed till January 2021. President Joe Biden has continued in lockstep with further mortgage extensions.

As is mostly the case for both occasion that holds the White Home when midterm elections roll round, Democrats face a steep climb to retain seats and their management in Congress. I count on one other extension simply earlier than the mid-terms in November to convey youthful voters to the polls and even up the race in Congress. If scholar loans are pushed again once more, assume that funds will resume on January 1, 2023.

2 Frequent Paths for Paying Down Pupil Loans

Two of the most typical paths for paying down your loans are:

- Revenue Pushed Reimbursement (IDR) to Public Service Mortgage Forgiveness (PSLF)

- Personal Refinancing

There are a choose few of you pursuing 20-25 yr taxable mortgage forgiveness. However most high-earners who learn this weblog would by no means want to think about it an possibility except they’re in a selected scenario.

Let’s focus on these two widespread paths and a manner to consider them whereas the scholar mortgage vacation nonetheless exists.

Why It’s a Dangerous Thought to Pay Now If You ARE Going for Pupil Mortgage Forgiveness

In case you are going for scholar mortgage forgiveness, your goal is to reduce your month-to-month funds as a lot as potential. Whereas funds and curiosity are on maintain, every of those months will rely as credit score towards your forgiveness monitor even when you’re not truly paying any cash (bear in mind, to achieve PSLF, it is advisable make 120 on-time funds). For these pursuing PSLF, all you want is qualifying employment—full-time employment at a non-profit or 501(c)(three)—for these months to rely as credit score.

At this level, you’re not required to make a month-to-month fee on direct federal scholar loans. This implies you should not put cash towards your federal loans except you are attempting to pay them off earlier than you attain forgiveness. Every greenback you do not pay to your loans is a greenback you’ll be able to repurpose any manner you’d like, whether or not that’s saving for retirement, saving for school, shopping for a rental property, or buying that dream residence.

Making funds to your servicer now if you’re going for forgiveness is like throwing your right into a black gap. Simply bear in mind, you need to MAXIMIZE your forgiveness at this level and never pay a penny extra.

These months with $zero required month-to-month funds rely towards these 120 funds simply as a lot as these excessive month-to-month funds you have been making pre-pandemic— or these funds you’re anticipated to make when your earnings jumps after coaching and when the scholar mortgage vacation ends.

Why It’s a Good Thought to Pay Now If You’re NOT Going for Pupil Mortgage Forgiveness

For those who’re not going for scholar mortgage forgiveness, there’s a superb likelihood you have to be paying down your scholar loans now when you’ve got a long-term horizon of 15-20 years. The reason being that most individuals not pursuing mortgage forgiveness will privately refinance their scholar loans, as a result of they will usually minimize their rate of interest in half. This course of can save the borrower 1000’s of in the long term.

Many planning to refinance their federal scholar loans have stayed on the sidelines in the course of the federal mortgage vacation, stacking these Benjamins in a high-yield saving account, an index fund, or their favourite crypto. There was no motive on the time to privately refinance, as a result of they might be excluded from the zero% curiosity, must start reimbursement earlier when the charges have been nonetheless low, and would lose the possibility that every one or a portion of their loans have been coated by widespread mortgage forgiveness.

Nonetheless, with inflation spiking to the best its been because the 1980s, the Federal Reserve has begun elevating charges to assist offset inflation. The primary charge hike was in March 2022, and the Fed has indicated there can be extra in the course of the yr.

Those that are planning to refinance over a long run might find yourself worse off in the event that they don’t refinance their loans now with rates of interest rising. Listed here are two examples that assist clarify it:

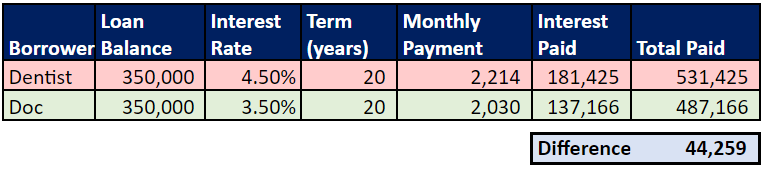

1) A dentist owes $350,000 in scholar loans at a 7% rate of interest. Their loans are rising at $24,500 per yr ($350,000 * 7.00%). The borrower, who continues to pay nothing in the course of the mortgage vacation, then refinances to a 20-year mortgage at four.5% on the finish of the federal mortgage vacation.

2) A health care provider owes $350,000 in scholar loans at a 7% rate of interest and decides to choose out of the federal mortgage maintain and refinance now to a 20-year mortgage at three.5% earlier than the rates of interest proceed to rise.

Dentist

- Month-to-month fee = $2,214

- Curiosity paid $181,425

- Complete paid = $531,425

Physician

- Month-to-month fee = $2,030

- Curiosity paid = $137,166

- Complete paid = $487,166

The distinction? The physician is out of debt 4 months earlier and pays ($531,425-$487,166) $44,259 lower than the dentist does. The rationale why the doc pays much less is due to the decrease rate of interest, regardless that they began paying their loans earlier and did not benefit from zero% curiosity.

Please observe: I am not suggesting charges will go up 1% by the tip of the yr, however they definitely might.

What when you’re planning to reside like a resident or pay your loans down in lower than 10 years? Let’s focus on this within the subsequent part.

Why It’s a Dangerous Thought to Pay Now If You’re NOT Going for Pupil Mortgage Forgiveness

It might be a nasty concept to pay down your loans now even when you aren’t going for scholar mortgage forgiveness. As talked about above, most who should not planning on mortgage forgiveness will privately refinance their scholar loans.

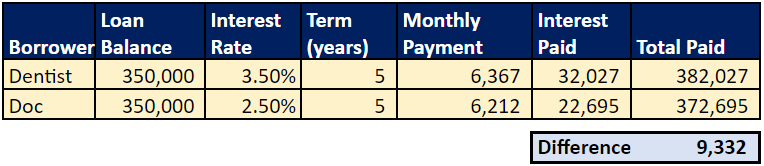

A lot of these are contemplating the danger of ready to refinance their personal loans with rates of interest rising. Those that are planning to refinance over a brief time period (5-7 years) might find yourself higher off in the event that they don’t refinance their loans now. Let me clarify with these two examples:

1) A dentist owes $350,000 in scholar loans at a 7% rate of interest. Their loans are rising at $24,500 per yr ($350,000 * 7.00%). The borrower then refinances to a five-year mortgage at three.5% on the finish of the federal mortgage vacation.

2) A health care provider owes $350,000 in scholar loans at a 7% rate of interest and decides to choose out of the federal mortgage maintain and refinance now to a five-year mortgage at 2.5%.

Dentist

- Month-to-month fee = $6,367

- Curiosity paid = $32,027

- Complete paid = $382,027

Physician

- Month-to-month fee = $6,212

- Curiosity paid = $22,695

- Complete paid = $372,695

The distinction? The dentist and the physician will now pay a a lot comparable quantity to pay down their scholar loans. However the physician nonetheless pays rather less due to the decrease rate of interest.

Once more, I can’t give you certainty that charges will go up 1% by the tip of the yr, however they definitely might. That is positively a scenario that deserves your consideration when working the numbers.

I perceive your scenario may not precisely match the instance. No matter you’re contemplating—PSLF, personal refinancing, or possibly a mixture of the 2 when you and your companion each have loans—don’t wait to execute on the optimum plan. The one factor I can give you certainty is that scholar mortgage guidelines and legal guidelines won’t cease altering.

Give up questioning about the way you’ll sort out your scholar loans and let an skilled guide you thru your choices right this moment!

Are you fascinated by making funds in the course of the scholar mortgage vacation? Why or why not? Remark beneath!